PPSL

Model & Strategy

The Project on Predatory Student Lending (PPSL) is the leading legal non-profit organization seeking to end predatory practices in higher education. PPSL’s unique model of impact litigation and advocacy delivers results for defrauded students and demands significant accountability for student borrowers in the higher education system. PPSL represents over 1 million clients and has canceled over $22 billion in fraudulent student debt.

The Problem

For decades, predatory actors in higher education have exploited students through high-pressure sales tactics, luring them into enrolling in high-cost, low-quality programs that promise a better future but ultimately trap them in cycles of poverty. This issue stems from fundamental flaws in the federal student loan program. Each year, the government dispenses an estimated $100 billion in student aid to students and their families, but the size and scale of the program

far exceed regulators’ capacity to effectively monitor it. This leaves an opening for predatory companies posing as legitimate colleges to lure students into taking on federal student loans for inferior educational offerings.

These institutions disproportionately target communities that rely on the “college promise” to improve their lives — low-income students, people of color, first-generation students, single parents, and veterans. It’s only after accumulating debt and either completing or failing to finish their programs that students realize they have been misled. With little accountability for the quality of education provided or the obligation to support job placement or loan repayment, these predatory practices continue unchecked. The result is a system driven by profit, rather than student success, across the entire higher education sector.

The Solution

PPSL’s unique model of high-impact litigation and advocacy delivers meaningful loan cancellation for defrauded students while demanding greater accountability within the federal student loan program. Through strategic litigation design, PPSL establishes a legal precedent that defines predatory student lending as involving a combination of consumer deception, bad student outcomes, allocation of resources away from students and toward advertising and profit, and racial targeting. PPSL leverages this precedent to secure loan cancellation, financial restitution, and credit repair for students impacted by predatory lending. PPSL presents evidence from litigation, alongside personal stories from clients, to policymakers, advocating for reform and accountability. PPSL mobilizes their community to share stories with the media, testify before lawmakers, and advocate for policies that protect future borrowers.

As PPSL scales, they will cancel more predatory debt each year than is newly created, and the time between loan creation and cancellation

will steadily decrease. PPSL will achieve this by building a connected network of engaged and empowered clients, guiding as many borrowers as possible into pathways to cancellation forged through their own litigation. PPSL will also identify predatory practices as they happen and respond with targeted litigation to defend clients’ legal and moral right to pursue education and training free from exploitative debt.

Eileen has extensive litigation experience in the field of predatory student lending. Most recently, she was a senior staff attorney in the special litigation unit of the New York Legal Assistance Group, where she was counsel on multiple consumer class-action lawsuits concerning student loan debt, and a founder of NYLAG’s For-Profit School Project. Eileen holds a BA from Brown University and a JD from NYU School of Law. She is a grateful recipient of student loan forgiveness through the Public Service Loan Forgiveness (PSLF) program.

Impact

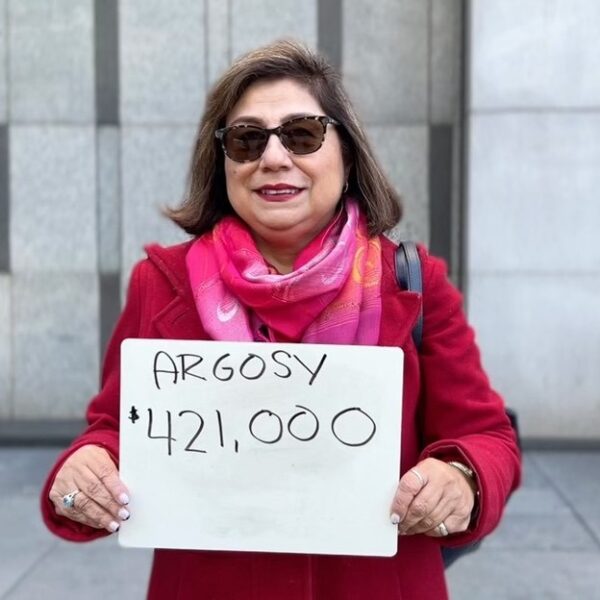

PPSL’s litigation and advocacy have led to the cancellation of more than $22 billion in fraudulent student loans for over 1.8 million borrowers.

$900 million in refunds has been issued to over 150,000 borrowers.